How Banks can Participate in the Main Street Lending Program

By BankLabs | June 22, 2020

General Information

The Main Street Lending Program was established by the CARES Act to provide liquidity to lenders that make loans to qualified businesses. The Federal Reserve and U.S. Treasury have allocated a total of $600 billion to the Main Street Special Purpose Vehicle (SPV) for loan participations until September 30, 2020.

There are 3 main facilities that can be made to new or existing customers:

- Main Street New Loan Facility (MSNLF)

- Main Street Priority Loan Facility (MSPLF)

- Main Street Expanded Loan Facility (MSELF)

Each vehicle has a 5-year term, allows the originator to participate up to 95% of the loan to Main Street SPV, and requires the originator to retain 5% of the loan.

Banks that wish to participate in the Main Street Lending Program should register with the Federal Reserve Bank of Boston.

What are the Main Street Lending Program Loan Types?

Links to the comprehensive Lender Transaction Specifics and Covenants as well as Borrower Certifications and Covenants on each facility are included below.

MSNLF Quick Stats:

- Size: $250,000 – $35 Million

- Closing Fee: 100 basis point fee paid to Main Street SPV, lender can charge borrower up to 100 basis points

- Servicing Fees: Main Street SPV will pay 25 basis points on the principle amount of its participation per annum for loan servicing

MSNLF Lender Transaction Specifics and Covenants & MSNLF Borrower Certifications and Covenants

MSPLF Quick Stats:

- Size: $250,000 – $50 Million

- Interest Rate: Adjustable, LIBOR (1 or 3 month) plus 300 basis points.

- Closing Fee: 100 basis point fee paid to Main Street SPV, lender can charge borrower up to 100 basis points in closing fees

- Servicing Fee: Main Street SPV will pay 25 basis points on the principle amount of its participation per annum for loan servicing

MSPLF Lender Transaction Specifics and Covenants & MSPLF Borrower Certifications and Covenants

MSELF Quick Stats:

- Size: $10 Million – $300 Million

- Closing Fee: 75 basis point fee paid to Main Street SPV, lender can charge borrower up to 75 basis points in closing fees

- Servicing Fee: Main Street SPV will pay 25 basis points on the principle amount of its participation per annum for loan servicing

MSELF Lender Transaction Specifics and Covenants & MSELF Borrower Certifications and Covenants

Borrower Requirements

The program requires that borrowers:

- Are U.S. businesses established before March 13, 2020

- Are not types of businesses excluded under 13 CFR 120.110(b)-(i), (m)-(s) as modified under SBA’s recent interim final rules available at 85 Fed. Reg. 20811, 85 Fed. Reg. 21747, and 85 Fed. Reg. 23450

- Have 15,000 employees or fewer or have $5 Billion or less in revenue for 2019

- Only participate in one of the Main Street facilities and do not participate in the Primary Market Corporate Credit Facility (PMCCF)

- Do not receive specific support under the Coronavirus Economic Stabilization Act of 2020 (Subtitle A of Title IV of the CARES Act)

- Can meet all of the certifications and covenants required under the program

Any eligible borrower, including those that have received PPP loans, qualify under the Main Street Lending Program.

Implications for Banks

- The Main Street Lending Program gives lenders an opportunity to serve current customers or win new ones with loans they need

- Participation from the Main Street SPV means they can do so while retaining up to 95% of the liquidity

- Originating banks can generate fee income through this program. Originators will still earn 25 basis points each year on the principle of the loan participation bought by the Main Street SPV over the 5-year loan term. Because the program is funded with $600 B, this means originators will be able to generate up to $7.5 B in servicing fee income

- Tracking and servicing these loans is worthwhile, but the loan participation process is manual and complicated

- To ease the burden of servicing, Banks that wish to lend under the Main Street program should consider using BankLabs Participate: software that automates loan participations

Using BankLabs Participate for the Main Street Lending Program

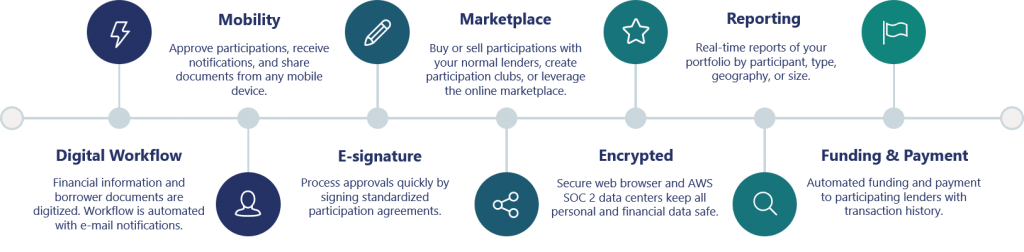

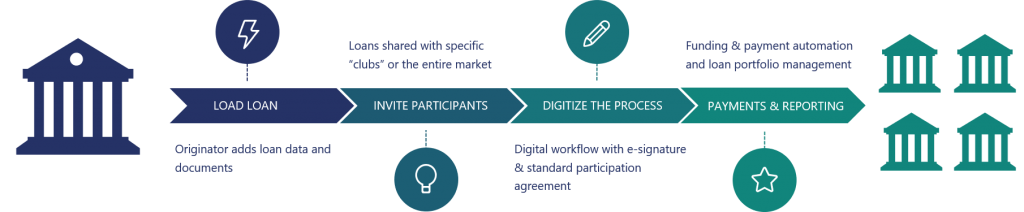

BankLabs Participate was created help institutions track and service loan participations with unprecedented efficiency. Our software can digitize the Main Street Lending Program’s loan participation agreements, servicing agreements, and co-lender agreements. Participate can give your bank the benefits of electronic document sharing, e-signature, and automated workflow for any type of loan participations.

These features allow your institution to:

- Streamline funding and payment management

- Generate real time portfolio reports

- Establish participation clubs with lending partners

These tools can help your institution dramatically increase the efficiency for any type of loan participation – and we can start today. Participate is cloud-based, it can launch instantly, and creating an account only takes 5 minutes. It’s never been easier to start our free trial!

For updates and additional information on the Main Street Lending Program, please refer to the Federal Reserve. BankLabs is a private company and is not affiliated with, or endorsed by, the Federal Reserve.