In “THE SILICON VALLEY BANK SAGA PART 1: WHAT HAPPENED? BY THE NUMBERS” we searched behind the popular press pronouncements to explore elements of Silicon Bank’s risky investment in long-term treasury instruments and how these investments eventually contributed to the failure of the Bank.

Banking is Packed with Inherent Risks

Banks constantly face a variety of risks in the ordinary course of their business: in receiving deposits and originating loans or investing deposits for a return in excess of the cost of the deposits. The Office of the Comptroller of the Currency (OCC) has identified nine categories of risks banks face: Credit, Interest Rate, Liquidity, Price, Foreign Exchange, Transaction, Compliance, Strategic and Reputation.

Each day, Bankers must navigate this complex, shifting mine field of risks any one of which may be sufficient to sink the Bank.

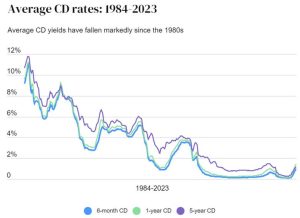

As recently demonstrated by the Silicon Valley Bank failure, interest rate risk alone may be sufficient to cripple and eventually destroy a bank. In SVB’s failure, the sixteenth largest bank in the United States was unable to fend off a full-fledged bank run. It succumbed to a tsunami of withdrawals in only a matter of a few days.

The Bank’s end was swift and sure.

Who’s Responsible for Addressing Interest Rate Risk?

The short answer is: everyone in banking governance and management is responsible.

In a 2010 document “Advisory on Interest Rate Risk Management”, the FDIC sets out general standards for IRR management. Numerous subsequent pronouncements by each regulator reinforce the general framework expressed in this Advisory.

The Advisory admits the interest rate risks banks and bankers face ”The regulators recognize that some degree of IRR is inherent in the business of banking.”

Responsibility is then heaped on the Board of Directors –

“Existing interagency and international guidance identifies the board of directors as having the ultimate responsibility for the risks undertaken by an institution – including IRR.” (Emphasis added)

Senior management then gets its share of responsibility –

“Senior management is responsible for ensuring that board-approved strategies, policies, and procedures for managing IRR are appropriately executed within the designated lines of authority and responsibility.” (Emphasis added)

If you are reading this post, you likely have responsibility for conquering interest rate risk at your institution. Ominously, the penultimate paragraph contains an admonition regarding the failure of Directors and Managers to effectively manage IRR –

“Material weaknesses in risk management processes or high levels of IRR exposure relative to capital will require corrective action.”

History will determine the degrees of responsibility of the Board and Managers of Silicon Valley Bank bear in the Bank’s stunning failure.

What’s a Banker To Do?

In a section title “Risk Mitigating Steps” the FDIC provides some general guidance as to tools to manage IRR. Specifically, should IRR exceed or approach the institution’s limits “institutions can mitigate their risk through balance sheet alteration and hedging.”

Bankers should not wait until the risk threshold is in sight (or is behind them) to take action. Proactive balance sheet management helps banks avoid traps like the traps Silicon Valley Bank faced.

The next paragraph describes appropriate hedging activities but no guidance is provided regarding “balance sheet alteration.”

Bankers understand the asset side of the Balance Sheet. Assets revolve around two accounts: Cash and Loans Receivable.

Originating loans can be time consuming. Properly structuring loans may require expertise that is outside the bank’s skill set. Local loan demand may be insufficient to meet the bank’s lending needs. Loan servicing can be expensive and tedious.

Participate solves these problems. By providing a device-independent platform common to both Originators and Participants, participation communication is streamlined. Participation documents can be securely shared, and messages can be exchanged between Originator and Participant from within the Participate platform. The tedious back and forth process of agreeing on terms and executing Participation Agreements is handled with the click of a button. Standardized documents can be e-signed in a quick and seamless workflow.

The old participation slog can be reduced from days or weeks to minutes or hours.

Servicing is simplified. No more maintaining complex, error-ridden, non-audit friendly spreadsheets. Participants can opt-in to receive email and in-platform notifications each time a participation document is uploaded, a payment is disbursed to a participant or a draw and been processed and the participant’s share is requested. Printable forms contain wire instructions allowing them to be used as support for wire transactions by either the originator or the participant. They provide a firm audit trail.

Buying and selling participations allows banks to manage borrower concentrations, manage loan type and geographic concentrations and brings horsepower to the regulatory admonition to “mitigate risk through balance sheet alteration.”

Participate also provides a national marketplace for the purchase and sale of participations greatly expanding the scope of a bank’s contacts.

Talk to BankLabs (501.246.5148) or sales@banklabs.com) to discuss how we can help you manage interest rate risk.